Sales of new cars in South Africa on decline

Sales of new cars in South Africa has been on the decline due to low business confidence and the expected increase in taxes in this years' budget that is likely to further erode real purchasing power.

The latest data from the National Association of Automobile Manufacturers of South Africa (NAAMSA) shows that the decline in new vehicle sales has continued since December 2016.

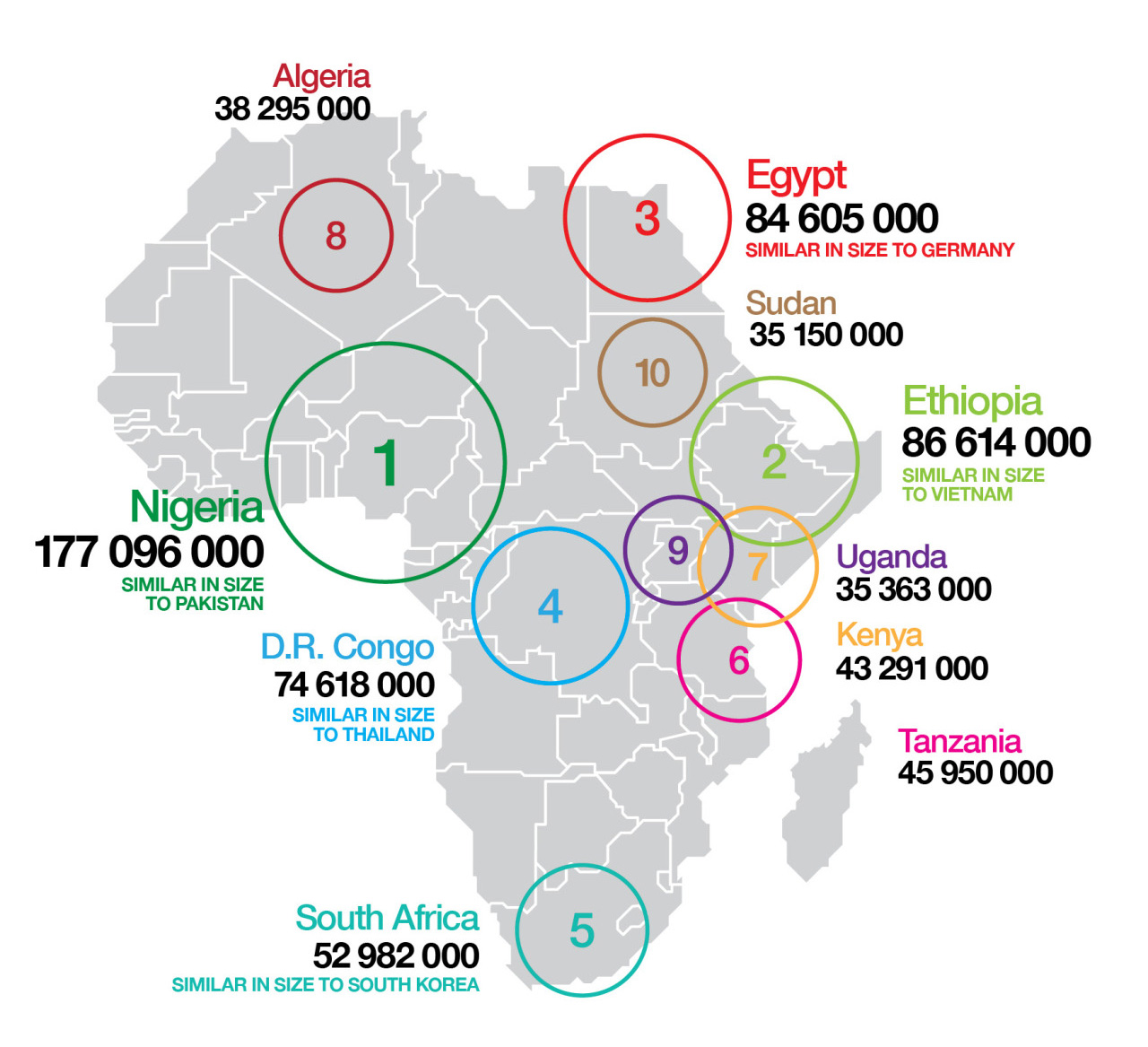

A total of 41,639 vehicles were sold in December 2016, a year-on-year decline of 15.3%. New vehicle sales for the year are down 11.4%, ending the year on 547 442 units; the lowest levels seen since 2010.

Will 2017 see the local auto industry recover? Will car prices drop or rise? What about vehicle exports? Naamsa answers these questions and more below:

What are 2018 vehicle sales expectations?

"2018 is expected to be another difficult year for the domestic SA auto industry, however, a modest improvement in new vehicle sales is expected during the second half of the year," reports the Naamsa.

Industry production levels, on the back of expected further growth in vehicle exports, should however remain in an upward phase.

Naamsa says its 2018 projections for South Africa reflect an expected improvement in GDP growth to around 1.5% (from 0.4% in 2017). Local political tensions are likely to reduce business confidence and the expected increase in taxes in this years' budget will erode real purchasing power. Internationally, volatile and uncertain conditions are likely to prevail during 2018.

SA car exports to remain strong

Despite these considerations, the global economic outlook at this stage, remains positive and should continue to lend support to South Africa's improving vehicle export performance. Ultimately, industry vehicle exports would remain a function of the performance and direction of global markets. Naamsa said: "Vehicle exports to Europe, Australasia, the United States, Asia and South America were expected to show further upward momentum."

Local car sales to 'remain flat'

The general expectation in the industry is that domestic new vehicle sales will remain fairly flat going into 2017. Naamsa remains hopeful, however, that on the back of the expected improvement in key economic indicators, domestic sales would regain some traction in the second half of 2017 with year over year growth perhaps settling in the 2.5% to 3.5% range and hold to around that level going forward.

Factoring in the expected improvement in exports, domestic production of motor vehicles in South Africa was expected to show an increase from 604,000 vehicles produced in 2016 to close on 641,000 vehicles in 2017– an improvement in vehicle production of about 6.0% This figure could prove conservative if vehicle exports expand more than currently anticipated.

The projected higher vehicle production was consistent with the official vision for the Industry which is to remain a premier supplier of high quality, competitive automotive original equipment parts and accessories and vehicles to international markets and, in the process, to achieve an annual domestic vehicle production figure of close to 850,000 vehicles by 2020.

New models, self-driving cars

Internationally and domestically, vehicle manufacturers would continue to focus on new models and products through sustained investment and new technologies. Technologies such as artificial intelligence could begin to reflect a tangible impact across sectors. Autonomous vehicles and driver assisted automatic systems as well as increased use of information technology in vehicles were likely to feature in the future.

South Africa’s new vehicle industry grew 2.1% in March 2017, with total sales of 48 534 vehicles according to the latest data from the National Association of Automobile Manufacturers of South Africa (Naamsa).

This follows a minor decline of 0.1% in February and growth of 3.7% in January. New vehicle sales, year-to-date, are up 1.9%.

Match 2017: Spending money confidently

In March 2017, out of the total reported industry sales of 48,534 vehicles, an estimated 42,772 units or 88.1% represented dealer sales, 6.7% represented sales to the vehicle rental Industry, 3.0% government and 2.2% industry corporate fleets.

Domestic sales of industry new light commercial vehicles (LCVs), bakkies and mini buses at 14,882 units during March 2017 reflected a marginal improvement of 169 units or a gain of 1.1% compared to the 14 713 light commercial vehicles sold during the corresponding month last year.

Rudolf Mahoney, head of brand and communications at WesBank, said: “March’s sales performance is indicative of the positive sentiment in the economy during the past month. There were a few contributing factors, including a strong Rand and falling fuel prices.

"Consumers had many reasons to feel confident enough to spend money, and this is immediately evident in the new vehicle sales.”

This sales performance and consumer confidence is reflected in the demand for vehicle finance. WesBank says its internal data shows growth of 8% for new vehicle finance, compared to March 2016. This past month also saw the average new vehicle price reach an all-time high, representing an 8% increase year-on-year.

The strong demand for new vehicles was not at the expense of used vehicle sales, where application volumes were 13.4% higher than the same time last year. Consumers shopping in the used market during March were also spending 8.6% more on average, than last year.

Mahoney concludes: “However, this positivity is going to be short-lived. The current political climate has introduced massive uncertainty in all South African markets. Both business and consumer confidence have been shaken, and this will filter through to the ratings agencies as well. The Rand’s sharp decline has already wiped out the benefit of lower fuel prices, and if it continues to deteriorate, new vehicle prices will follow suit.”