Kenya's Automotive Market

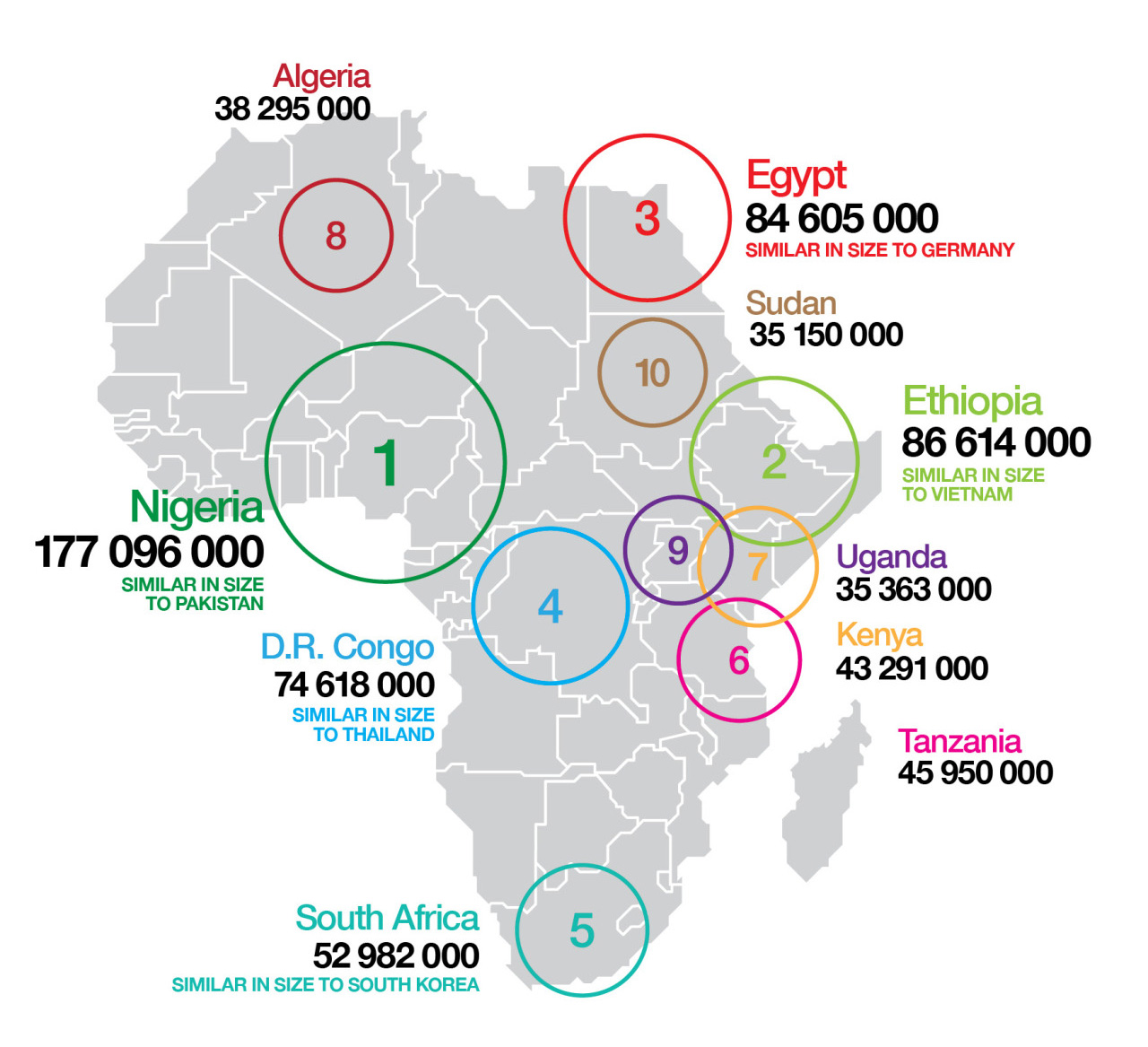

Kenya’s GDP per capita is expected to reach US$1,432 by the end of 2015 and to grow at a CAGR of 7.5% between till 2020. This is expected to result in an increase in private consumption and amongst other things, drive the sales of motor vehicles. Expenditure on the purchase of cars, motorcycles and other vehicles accounted for 1.5% of total consumer expenditure in 2015 and is expected to remain relatively stable to 2025 as incomes rise.

The volume of imported cars and motorcycles has been on the increase due to the availability of attractive credit from financial institutions and the rise of the middle class. According to the Kenya National Bureau of Statistics (KNBS) the volume of imported vehicles between 2003 and 2012 have grown at over 300% from 33,000 units to 110,474 units. Passenger vehicles were Kenya’s fourth largest import overall in 2015, valued at approximately US$440 million and making up 2.4% of total imports (by value) while commercial vehicles ranked seventh, valued at US$380 million. If the current trend of 10% to 12% growth per annum on vehicle imports is to be maintained, Kenya will have five million vehicles on the road by the year 2030.

The volume of imported cars and motorcycles has been on the increase due to the availability of attractive credit from financial institutions and the rise of the middle class. According to the Kenya National Bureau of Statistics (KNBS) the volume of imported vehicles between 2003 and 2012 have grown at over 300% from 33,000 units to 110,474 units. Passenger vehicles were Kenya’s fourth largest import overall in 2015, valued at approximately US$440 million and making up 2.4% of total imports (by value) while commercial vehicles ranked seventh, valued at US$380 million. If the current trend of 10% to 12% growth per annum on vehicle imports is to be maintained, Kenya will have five million vehicles on the road by the year 2030.

In the early 1980s, Kenya banned the importation of FBUs. At the time, Kenya was assembling approximately 18,000 units locally. Following a World Bank-imposed structural adjustment programme (SAP) in mid-1993, the country removed a large number of trade restrictions and the economy underwent liberalisation, allowing the importation of FBUs. As no age limit was imposed on vehicles imported, second-hand imports, some up to 20 years old, flooded the market.

To date, Kenya is still highly dependent on imports to meet domestic demand, with imports making up 94% of bilateral automotive trade and second-hand vehicles accounting for over 80% of those imports. Both passenger and commercial vehicles feature in Kenya’s top ten imports by value. As the regional gateway on account of the Port of Mombasa, 99.9% of Kenya’s automotive exports are to other African countries, with Uganda and Tanzania being the biggest markets.

Africa Automotive Directory

The African Automotive Directory compiled by Africa Business Pages has emerged as a helpful resource for those looking for buyers of automotive spare parts in Africa. The Africa Automotive Directory lists all major auto parts importers in 49 African countries and is available for immediate download in Excel format. This special directory is updated every six months is available for sale at the Africa Business Pages B2B portal at a nominal cost of US$350.

The African Automotive Directory compiled by Africa Business Pages has emerged as a helpful resource for those looking for buyers of automotive spare parts in Africa. The Africa Automotive Directory lists all major auto parts importers in 49 African countries and is available for immediate download in Excel format. This special directory is updated every six months is available for sale at the Africa Business Pages B2B portal at a nominal cost of US$350.

The Africa Automotive Directory has helped many exporters, manufacturers and dealers of automotive spare parts connect with their business counterparts in the African markets and develop direct business relations and expand their sales and distribution network in key African markets.

Kenya: Booming Market for Automotive Spare Parts

Although Kenya used to have large volumes of grey and illegal imports, this has been reduced through a number of government interventions, and as a result the used imported market is now more regulated. The Kenya Revenue Authority and the Kenya Bureau of Standards are situated at entry ports such as the Port of Mombasa and Jomo Kenyatta International Airport to monitor and record the arrival of vehicles. Vehicles entering through these ports that are destined for countries other than Kenya, such as Uganda, have to receive their clearance and payment confirmation of registration fees from the destination country before they are able to leave the port of entry.

Vehicles Numbers

It is estimated that approximately 80% of Kenya’s total vehicle fleet are second-hand vehicles, with a total vehicle fleet of around 1.4 million units in 2015. In 2014, the average age of vehicles on Kenya’s roads was 15 years, which has resulted in high levels of pollution, frequent break-downs of vehicles, and a large non-genuine spare parts industry developing. The total number of vehicles in use grew at a CAGR of 7.7% between 2005 and 2015. Figures for Kenya’s motorisation rate differ depending on the source, and range between 26 and 28 vehicles per 1,000 persons. This is forecast to increase to 31.5 in 2019, reflecting vehicle ownership growing faster than Kenya’s population.

Vehicle Sales

According to the KNBS, a total of 112,536 vehicles were registered in 2015 – this included newly registered and re-registered vehicles. KNBS does not differentiate between the registration of new vehicles and the re-registration of used vehicles, whereas the Kenya Motor Industry (KMI) only records new vehicles sold.

KMI states that 19,523 new vehicles were sold in Kenya in 2015, reflecting the dominance of used vehicles in the retail market. In 2015 light and heavy commercial vehicles combined accounted for 86% of total vehicle sales, highlighting the importance of larger vehicles, such as light commercial vehicles, minibuses, heavy trucks, and buses. Sedans and SUVs made up 14%. Heavy commercial vehicles too saw the highest growth, with a CAGR of 17.5% between 2005 and 2015 and thus were key drivers underpinning new vehicle sales growth over that period.

Sales of new vehicles in Kenya are driven by the demand for transportation in the construction, mining, agri-business, tourism, energy and retail sectors. The government and in particular its law enforcement and security authorities are significant buyers of new vehicles.

Sales of new vehicles in Kenya are driven by the demand for transportation in the construction, mining, agri-business, tourism, energy and retail sectors. The government and in particular its law enforcement and security authorities are significant buyers of new vehicles.

The most popular second-hand vehicles cost between Ksh350,000 and Ksh500,000.

In light of current growth drivers, business fleet purchases make up a significant proportion of total vehicle sales. It is expected that firms investing in Kenya’s economy will drive stronger demand for business fleet purchases, particularly given the number of major infrastructure investments in the country in recent years, notably the Lamu Port-South Sudan-Ethiopia-Transport (LAPSSET) Corridor Project. The Kenya Local Government Sector Reform Strategy has given greater budgetary autonomy to local governments (Counties), resulting in County governments expanding their vehicle fleets and further driving local demand.

Production and Assembly

Kenya’s automotive market is largely focused on retail and distribution of vehicles, and after-sales support in servicing and spare parts sales. Small scale assembly of motor vehicles is done at three assembly plants, the General Motors East Africa (GMEA) plant in Nairobi, the Associated Vehicle Assemblers (AVA) plant in Mombasa and the Kenya Vehicle Manufacturers (KVM) plant in Thika. All three of the plants are operating below their capacity. However, the country’s good infrastructure, relative to other countries in the region, as well as its physical and strong economic position within the East Africa Community (EAC), make it a potential hub for automotive assembly and production in the region.

Recently, counties have been lobbying with investors to set up manufacturing hubs in their regions to provide employment and promote trade within their jurisdictions. In February 2016, Machakos County signed a deal with Ashok Leyland to set up an assembly plant in the county recently.

counties have been lobbying with investors to set up manufacturing hubs in their regions to provide employment and promote trade within their jurisdictions. In February 2016, Machakos County signed a deal with Ashok Leyland to set up an assembly plant in the county recently.

Locally produced vehicles are assembled from CKD kits with minimal locally produced inputs. KMI defines CKDs as a package of most or all of the individual parts of a vehicle, as separate pieces. All of the pieces are brand new from their country of origin. As Kenya does not locally assemble sedans (except occasionally on an ad hoc basis), commercial vehicles dominate Kenya’s domestic production – a similar focus employed in the early stages of Thailand’s automotive sector. In 2015, Kenya assembled 9,295 vehicles, of which 921 (close to 10% of assembly) were light commercial vehicles (LCVs) such as pick-up trucks, and the rest of the 9,295 were heavy commercial vehicles (HCVs) such as trucks and buses.

The assembly of motor vehicles in Kenya grew by almost 32% from 2013 to 2015. High growth of 54.4%, 43.7% and 20.8% was registered in the production of pick-ups, trucks and buses respectively. Kenya’s vehicle assembly figures are forecasted to almost double between

2013 and 2019.

Policy Environment

The Kenyan government has identified the automotive and auto parts industry as a major economic driver in the Kenya National Industrialisation Policy Framework released in 2010. In order to build up its automotive industry, the framework identified five policy statements:

1. The development of a 40 hectare automotive industrial park in Machakos by 2012;

2. Providing incentives to encourage locally assembled vehicles and the production of autos parts in order to gradually replace imported

second-hand vehicles with locally assembled vehicles;

3. The establishment of a National Automotive Industry committee which would be tasked with developing the automotive value

chain and co-ordinating the industry;

4. Impose high tariffs on automotive parts that could rather be produced locally to encourage the growth of a local industry; and

5. Set up a joint venture with an established automotive manufacturer by 2016 with the goal of domesticating the company within ten years.

While to date, most of the goals are yet to be realised, the government has devised a number of policies such as a 30% local input requirement for locally assembled vehicles (although this had not been implemented at the time of writing). The Kenyan government has also committed to supporting entrepreneurs in the automotive components industry, developing the auto components supply chain, placing high tariffs on imported automotive components that could be manufactured locally and the formation of a national automotive industry board.

All vehicles imported for use in Kenya attract an IDF (Import Declaration Fee of 2.25% of CIF) and RDL (Railway Development Levy of 1.5% of CIF) tax and are depreciated based on the year of manufacture and registration. Vehicles imported as CKDs attract 0% import duty but can only be imported by a licensed manufacturer. CKD kits are assembled in a KRA Bonded Warehouse facility and are only then required to pay IDF fees. However, as soon as these are removed from the bonded facility and are used in Kenya, they are subject to value added tax (VAT), excise duty and the RDL. Vehicles assembled in Kenya for export are not subject to domestic taxes.

All vehicles imported for use in Kenya attract an IDF (Import Declaration Fee of 2.25% of CIF) and RDL (Railway Development Levy of 1.5% of CIF) tax and are depreciated based on the year of manufacture and registration. Vehicles imported as CKDs attract 0% import duty but can only be imported by a licensed manufacturer. CKD kits are assembled in a KRA Bonded Warehouse facility and are only then required to pay IDF fees. However, as soon as these are removed from the bonded facility and are used in Kenya, they are subject to value added tax (VAT), excise duty and the RDL. Vehicles assembled in Kenya for export are not subject to domestic taxes.

In July 2015 the Ministry of Industrialisation proposed policy measures in the Policy Framework for Motor Vehicle Assembly in Kenya to complement the National Industrialisation Policy Framework. The policy aims to promote new investments in the country’s automotive industry and for Kenya to become a globally competitive vehicle manufacturer.

The 2015 framework aims to impose a tax of 2% on all imported FBU units, the creation of an Automotive Innovation Fund (AIF) to support research and development in the sector and the inclusion of the sector in special economic zones (SEZs), with the SEZ Bill passed at the end of 2015. Local assemblers and eventually producers located in SEZs will be afforded benefits including ten year tax holidays, low utility rates, and export credits.

The new framework, similar to the National Industrialisation Policy Framework, aims to create a National Automotive Council (NAC) which will be equipped to address aspects relating to the assembly and manufacture of vehicles, including capacity building and the proposal and implementation of incentives.

The 2015 Policy Framework for Motor Vehicle Assembly in Kenya differs from the 2010 National Industrialisation Policy Framework in that engagement with the private sector has been more consistent. Rather than focusing on industrialisation as a whole and manufacturing more broadly, the new framework is centred on the automotive industry with a structure to drive local production. Stakeholders in Kenya’s automotive industry were engaged with to a greater degree than before and as a result the 2015 framework is seen as an improvement on the previous framework and a step in the right direction.

In contrast to other EAC markets, vehicles older than eight years are not permitted for import into Kenya. Although, there is anecdotal evidence of cases of importers forging import documentation of older vehicles, this law is largely abided by and the industry believes that government implements it effectively.

All imported vehicles undergo a roadworthiness inspection and the Ministry of Industrialisation is in the process of lowering the legal age limit of second-hand vehicles imported into the country to five years. This should reduce the number of imported used vehicles, as newer second-hand cars will be more expensive.

Within the EAC, products substantially transformed (i.e. from CKD to full assembly) in any of the member states (Burundi, Kenya, Rwanda, Tanzania and Uganda) should be sold on a duty-free basis in the other member states. In 2009 EAC member states ratified a Common External Tariff (CET) of 25% on vehicles imported into the region, hoping to drive local assembly. However, the other EAC countries have requested that the implementation of the CET be put on hold and continue to impose duties on vehicles assembled in Kenya, which currently is the only country in the EAC with the capacity to assemble vehicles.

Tanzania and Uganda’s arguement is that vehicles assembled in Kenya do not abide by Tanzania and Uganda’s local content requirement of 35% and therefore do not qualify for duty-free access to these markets. Vehicles assembled in Kenya are therefore imported into these markets with a CET of 25%. This has resulted in imported vehicles having an advantage over vehicles assembled regionally, as cars arriving from Japan in Uganda and Tanzania are cheaper than vehicles assembled in Kenya. However, the Kenyan government is engaged in talks with other EAC states and it is likely that the issue will be resolved in the short term.

Beyond the domestic policy focus on the automotive sector, Kenya was also identified by the EAC as a potential vehicle production hub for the region in its draft East African Industrialisation Strategy 2010-2030 released in 2010.

The draft argued for encouraging major carmakers that already imported vehicles into the region to rather produce locally. However, this was left out of the final EAC Industrialisation Strategy 2012-2032, where the assembly of cars, buses and tractors and vehicle spares was identified as having the least growth potential in the region of 20 industries considered. Industry stakeholders interviewed however recognised the opportunity of both the regional parts value chain as well as the EAC as an export market for Kenyan produced vehicles and parts.

The draft argued for encouraging major carmakers that already imported vehicles into the region to rather produce locally. However, this was left out of the final EAC Industrialisation Strategy 2012-2032, where the assembly of cars, buses and tractors and vehicle spares was identified as having the least growth potential in the region of 20 industries considered. Industry stakeholders interviewed however recognised the opportunity of both the regional parts value chain as well as the EAC as an export market for Kenyan produced vehicles and parts.

One of the greatest inhibitors to the advancement of Kenya’s automotive sector is the proliferation of second-hand vehicles available in the market. Decreasing the age of cars allowed for import while simultaneously decreasing the affordability of these cars by increasing the taxes levied on them should drive sales of more affordable, newer, roadworthy, and locally-assembled cars.

Incentives to assemble locally, such as tax breaks or waiving of import duties for parts, will make it more affordable to assemble vehicles in Kenya in the short to medium term and could encourage production in the long term.

Also, definitions of local content need to be developed and aligned to the other EAC members’ automotive and manufacturing policies. These need to be accepted regionally, especially within the EAC, for Kenya to pursue an East African automotive manufacturing hub and export strategy. The development and promotion of auxiliary industries in partnership with the vehicle assemblers will enable automotive companies to source high-quality inputs locally, further strengthening the case for local assembly.

The Kenyan government is particularly aware of the need to improve the country’s infrastructure, with programmes in place to increase electricity accessibility and either refurbish or build new transport infrastructure. Despite new investments in the country, Kenya’s automotive sector is relatively stagnant and runs the risk of being side-lined in the long term by other regional players such as Ethiopia, which has a more progressive approach

to industrialisation.