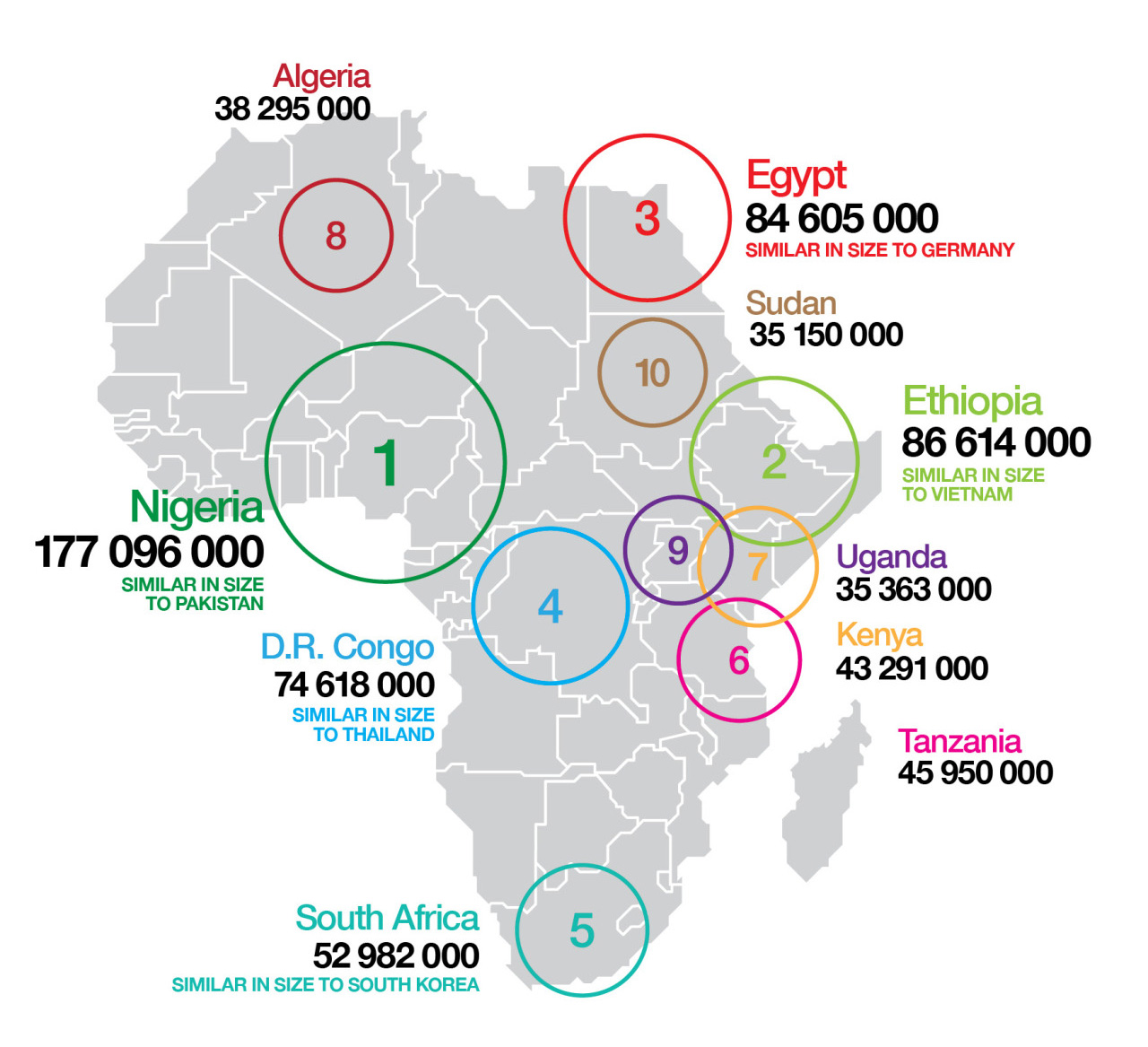

Nigeria Auto Market Could Be the Biggest in Africa by 2050

Nigeria can become a leading automotive hub in Africa by 2050 with an increase in local production and an expansion in new car markets. Currently, the Nigeria auto market has been saturated by imported used cars (Tokunbos) which were popular among the middle class due to flexible pricing compared to imported new cars but the expected spike in local production suggests that the importation of used cars will be curtailed by 2034. Nigeria’s annual new car market currently stands at over 50,000 but with projected growth, it can rise to as much 7.6 million in 2050.

Nigerians are expected to import as many as 335,000 used cars in 2017, also known locally as ‘Tokunbos’, as well as 90,000 new cars. But just about 35,000 cars will be assembled locally. This means that locally assembled cars account for roughly 15% of total car sales in Nigeria. However, this number could rise to 70% by 2050.

In recent years, papid GDP growth in Nigeria will visibly impact Nigeria's auto market. But GDP growth was not the sole condition necessary for the automobile industry to boom. With 63% of Nigerians unable to afford a car without some form of financial support, facilitating access to vehicle financing loans is also important. Last year, less than a third of all new cars sold in Nigeria, were sold to retail customers.

In recent years, papid GDP growth in Nigeria will visibly impact Nigeria's auto market. But GDP growth was not the sole condition necessary for the automobile industry to boom. With 63% of Nigerians unable to afford a car without some form of financial support, facilitating access to vehicle financing loans is also important. Last year, less than a third of all new cars sold in Nigeria, were sold to retail customers.

One of the biggest barriers for the Nigeria auto market is lack of credit. Most of the economies do not sell cars through a cash basis but they buy through borrowing, this needs to be addressed in Nigeria.

Similarly, the challenge with porous borders which allow car smuggling must be addressed to ensure that local production is protected. Tightening borders and regulating importation of cheap used cars will help Nigeria conserve foreign exchange as its annual car imports value – half of which is believed to be smuggled – stands at approximately $3.3 billion.

One of the key reasons for the progress in the growth of the local automotive industry is the National Automotive Industry Development Plan, an automotive policy announced by the government of Nigeria. The policy has already attracted interest and investment to Nigeria’s auto market as 30 car brands have obtained licenses to start assembly of cars in Nigeria but its implementation must remain enforced to allow for consistent growth. The government has already awarded licences for 14 new vehicle assembly plants. Names included Toyota, Honda, General Appliances West Africa and Nigeria-China Manufacturing Company.

Nigeria Auto Market: Africa's Largest

Nigeria’s auto market remains the largest in Africa, and the buying power of her middle class is increasing exponentially thus, presenting a huge opportunity in terms of consumption of auto products. This is despite infrastructure challenges, the President/CEO Sub Saharan African Region, Ford Motor Company, Jeff Nemeth has said. The company plans to launch at least 30 new vehicles by 2020 in Middle East & Africa with the ambition to corner 50 per cent of the Nigeria auto market.

The company’s Semi-knocked Down (SKD) vehicle assembly line in Nigeria with strategic partnership with local Ford dealer group Coscharis Motors Limited is located in Ikeja, Lagos. The Lagos assembly line accommodates one shift and produces an 10 units per day, while a gradually expansion is being planned over time.

Mitsubishi is also eyeing Nigeria auto market and is in early stages of its planning and negotiations with Nigerian stakeholders.

Mitsubishi is also eyeing Nigeria auto market and is in early stages of its planning and negotiations with Nigerian stakeholders.

The arrival of Chinese brands, and the pace at which Nigeria’s automotive hub is developing, is attracting other car manufacturers to Nigeria.

Toyota has invested R6.1 billion in their Durban plant, BMW is set to invest R6 billion in their Rosslyn plant, VW has earmarked 4.5 billion investment for their Uitenhage plant and Ford R2.5 billion in their Rosslyn plant, with Mercedes Benz investing R3 billion in their East London plant in 2013/14.

On the other hand, the trucking business in Nigeria has been expanding recently. As the rail system in Nigeria has collapsed, trucking has become increasingly important and lucrative, especially given the country’s favourable demographics in terms of population (which is over 168 million) and growth rate (which is currently around 6.8%). The growth of some industries, including in the petroleum and agriculture sectors and which are based on transport, has also raised demand for trucks. Trucking is an important component of the movement of goods to and from cities like Port Harcourt, Lagos, Abuja, Kaduna and Kano.

Africa Automotive Directory

The African Automotive Directory compiled by Africa Business Pages has emerged as a helpful resource for those looking for buyers of automotive spare parts in Africa. The Africa Automotive Directory lists all major auto parts importers in 49 African countries and is available for immediate download in Excel format. This special directory is updated every six months is available for sale at the Africa Business Pages B2B portal at a nominal cost of US$350.

The African Automotive Directory compiled by Africa Business Pages has emerged as a helpful resource for those looking for buyers of automotive spare parts in Africa. The Africa Automotive Directory lists all major auto parts importers in 49 African countries and is available for immediate download in Excel format. This special directory is updated every six months is available for sale at the Africa Business Pages B2B portal at a nominal cost of US$350.

The Africa Automotive Directory has helped many exporters, manufacturers and dealers of automotive spare parts connect with their business counterparts in the African markets and develop direct business relations and expand their sales and distribution network in key African markets.