Nigeria's Automotive Market

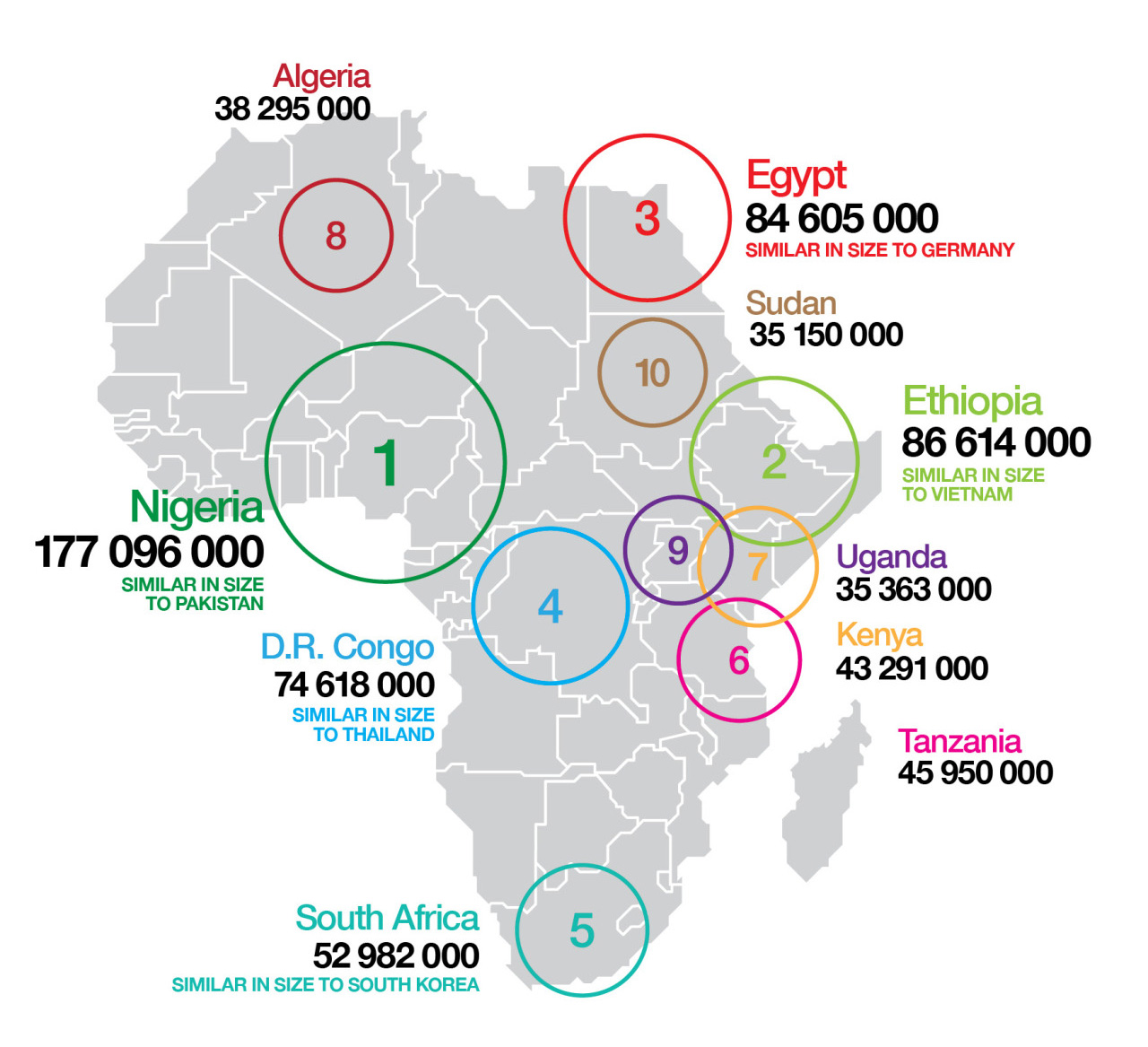

With a population of close to 180 million and a GDP of US$493 billion in 2015, Nigeria is the most populous country with the largest economy in Africa. Despite the current economic challenges facing the country due to low oil prices and a weakened currency, Nigeria still reveals robust economic growth of 2-4% in the medium term.

Owing to the lack of domestic vehicle production, Nigeria is highly dependent on imports to meet its domestic demand. In 2014, passenger vehicles constituted the second-largest import category after petroleum oils or bituminous minerals. Overall automotive related imports stood at US$6.9 billion (passenger vehicle imports: US$2.9 billion) accounting for approximately 11.5% of Nigeria’s total imports. While auto imports recorded rapid growth between 2004 and 2014, the current slowdown in the economy and the recent introduction of high import duties on vehicles linked to the new automotive policy has led to approximately a two-third contraction in vehicle imports according to industry players.

Owing to the lack of domestic vehicle production, Nigeria is highly dependent on imports to meet its domestic demand. In 2014, passenger vehicles constituted the second-largest import category after petroleum oils or bituminous minerals. Overall automotive related imports stood at US$6.9 billion (passenger vehicle imports: US$2.9 billion) accounting for approximately 11.5% of Nigeria’s total imports. While auto imports recorded rapid growth between 2004 and 2014, the current slowdown in the economy and the recent introduction of high import duties on vehicles linked to the new automotive policy has led to approximately a two-third contraction in vehicle imports according to industry players.

Second-hand vehicles dominate the import market. It is estimated that approximately 10% of vehicles imported to Nigeria are brand new. A large share of second-hand vehicles are imported from the US, given that vehicle specifications in this market are more in line with the demand and taste of Nigerian consumers, which is not always met by entry-level models from Europe.

Before the hike of import duties on second-hand vehicles, Nigeria imported more than 100,000 cars per year from the the US. In 2015, imports from the US had plummeted to less than 40,000 units. In addition to direct shipments to Nigeria, the Port of Cotonou in neighbouring Benin is a key transit point for second-hand vehicles destined for the Nigerian market. It is estimated that 85% of Benin’s used vehicle imports end up in Nigeria. In 2013, the European Union (EU) and the US exported approximately 300,000 cars to Benin. Based on the import figures for Benin, an additional 255,000 used cars from the EU and the US entered Nigeria via Benin.

There is no culture of maintenance in Nigeria – people drive their cars until they break down and then fix them.

Vehicle Numbers

Depending on the source of data, the current vehicle fleet in the country ranges from 1.3 million vehicles to 10 million vehicles. According to the Federal Road Safety Corps the total fleet size was 1.65 million units in 2015, of which approximately one third are concentrated in Lagos State. Even applying the least conservative estimate of vehicles in use, namely 10 million vehicles, Nigeria’s motorisation rate is approximately one-third that of the global motorisation rate with less than 60 vehicles per 1 000 people. Due to the New Automotive Industry Development Plan (NAIDP) launched in 2014 that increased the prices for imported vehicles, and the economic slowdown triggered by low oil prices, Nigeria’s growth in fleet size slowed down remarkably in 2015. However, it is expected that in the short term fleet growth will stabilise in a range between 4.5% and 5.5% per annum.

Vehicle Sales

Despite being the most populous country in Africa, Nigeria’s new vehicle sales lag behind less populated countries such as Algeria, Egypt, Morocco and South Africa. According to industry players, the overall new and second-hand market combined ranges between 500,000 and 1 million units per year. Smuggling, grey imports of second-hand vehicles and the lack of reliable data however, make the exact size of Nigeria’s vehicle market and fleet size difficult to quantify. Challenges concerning the licencing and identification of vehicles further contribute to this difficulty.

Imported second-hand vehicles, so-called tokunbos, dominate the Nigerian vehicle market as only a small segment of society is able to afford new vehicles. A representative of a leading automotive firm estimates that a mere 2% of the population is able to afford new vehicles given the current economic and financing environment. While commercial banks offer vehicle finance, accessing these credit facilities has become increasingly unattractive to individual consumers as credit facilities are provided at interest rates above 20% per annum and require at least a 10% down-payment.

Imported second-hand vehicles, so-called tokunbos, dominate the Nigerian vehicle market as only a small segment of society is able to afford new vehicles. A representative of a leading automotive firm estimates that a mere 2% of the population is able to afford new vehicles given the current economic and financing environment. While commercial banks offer vehicle finance, accessing these credit facilities has become increasingly unattractive to individual consumers as credit facilities are provided at interest rates above 20% per annum and require at least a 10% down-payment.

Commercial banks usually require repayment of vehicle loans within four years, due to the rapid depreciation of the value of vehicles given poor road conditions. According to one of the most established vehicle finance providers, the monthly repayment amount should not exceed 35% of the monthly income of the borrower. The short repayment-period as well as the high interest rates present a key challenge for low- and middle-income households when it comes to accessing vehicle finance.

Due to the limited accessibility to and expensive financing of vehicles, new vehicles remain out of reach for most Nigerians and the largest share of current vehicle demand comes from the business community. Corporate buyers account for approximately 70% of overall new vehicle purchases, indicating the suppressed demand from private buyers, arguably the market segment with the largest growth potential.

Through recently introduced promotional offers by banks in partnership with selected vehicle dealers, customers are able to access finance at a discounted rate for a limited number of vehicles and models. Indeed, the provision of alternative financing products, especially in-house financing by the automotive companies, is seen by industry players as a key requirement for the growth of the local market.

However, in the absence of affordable finance solutions, secondhand vehicles remain the more attractive option for private vehicle buyers. According to a representative of a leading automotive company, second-hand passenger vehicles accounted for 80% of sales in 2014. The share of tokunbos in the commercial vehicle market is even larger, reaching up to 90% of the market according to a leading commercial vehicle manufacturer.

However, in the absence of affordable finance solutions, secondhand vehicles remain the more attractive option for private vehicle buyers. According to a representative of a leading automotive company, second-hand passenger vehicles accounted for 80% of sales in 2014. The share of tokunbos in the commercial vehicle market is even larger, reaching up to 90% of the market according to a leading commercial vehicle manufacturer.

New vehicle sales are dominated by Toyota which accounts for almost one third of new sales. Hyundai and Kia have established themselves as increasingly serious competitors to Toyota due to their competitive pricing and improved image in terms of quality. In 2015, the three Asian brands accounted for half of new vehicle sales in the country.

The economic slowdown, the depreciation of the naira and the increase in vehicle prices due to the import duty hike had a substantial impact on new vehicles sales in 2015. Although vehicle sales saw positive growth post the global financial crisis, total new vehicle sales dropped by more than half in 2015, compared to 2014. The sharp decline of sales highlights the absence of sizeable and competitive domestic assembly that could provide an affordable alternative to imports and the dependency on vehicle imports to meet domestic demand.

Production and Assembly

Production and Assembly

Nigeria is no stranger to automotive assembly and manufacturing. Already in the 1970s Nigeria started assembling motor vehicles. In the 1970s and 1980s, the federal government of Nigeria partnered with six international automotive and commercial vehicle manufacturers to produce passenger and commercial vehicles locally from CKD kits. According to the National Automotive Council (NAC) these six companies had an initial installed capacity of 149,000 units per annum during the 1970s and 1980s.

“Sometimes, cars are imported to be stripped for parts as availability of genuine parts is limited.”

In addition to these plants, the Federal Government entered into five more agreements with international automotive companies to establish assembly plants in 1982, according to the National Automotive Design and Development Council Nigeria. These agreements included the establishment of plants by Isuzu in Maiduguri, Mazda in Umuahia, Mitsubishi in Ilorin, Nissan in Minna and Peugeot in Gusau. However, these plans did not materialise.

Furthermore, due to inconsistent policy implementation, corruption, declining patronage by local and federal government departments and lack of reliable power supply, the output and capacity utilisation of the six existing plants declined rapidly.

Symptomatic of the demise of Nigeria’s automotive industry was the stop of production activities by Peugeot Automobile Nigeria (PAN), Nigeria’s largest manufacturer, in 2010. Since then assembly plants have been lying dormant. By 2012, all of the country’s automotive manufacturers had been privatised as the government exited the existing partnerships, eroding any incentives for government departments to purchase locally assembled vehicles

The launch of Nigeria’s NAIDP in 2014 and the subsequent hike in import tariffs for vehicles has attracted the interest of leading international carmakers and has led to the resumption of small scale vehicle assembly in the country. While the high import tariffs are aimed at encouraging local assembly, the sharp drop in vehicle sales in Nigeria in 2015 is a strong indication that this measure had an adverse impact on overall vehicle prices in the absence of a sufficient assembly base that could provide substitutes for imported vehicles. In 2015, local assembly was only able to cover 10-15% of the new vehicle market.

The launch of Nigeria’s NAIDP in 2014 and the subsequent hike in import tariffs for vehicles has attracted the interest of leading international carmakers and has led to the resumption of small scale vehicle assembly in the country. While the high import tariffs are aimed at encouraging local assembly, the sharp drop in vehicle sales in Nigeria in 2015 is a strong indication that this measure had an adverse impact on overall vehicle prices in the absence of a sufficient assembly base that could provide substitutes for imported vehicles. In 2015, local assembly was only able to cover 10-15% of the new vehicle market.

According to a senior representative of one of the automotive companies present in Nigeria, approximately 1,000 passenger vehicles were assembled in Nigeria in 2015 – an even more conservative estimate. Currently, 35 companies are licensed to produce by the Nigerian Automotive Council under the NAIDP. Despite the increased focus on the automotive industry, the sector’s contribution to Nigeria’s GDP remains low at 0.07%.

At present the vehicles are assembled from imported SKD kits with a limited degree of local inputs-sourcing due to the lack of a reliable and adequate domestic supplier base. While current assembly figures are low, with Peugeot Automobile Nigeria recording the largest number of vehicles assembled in 2015 with 400 units, the automotive companies aim at increasing their annual output in order to capitalise on the long-term growth prospects of the Nigerian market. However, due to the current economic slowdown, expansion plans are likely to be delayed as reflected in the decline of employment levels in some of the assembly facilities.

Africa Automotive Directory

The African Automotive Directory compiled by Africa Business Pages has emerged as a helpful resource for those looking for buyers of automotive spare parts in Africa. The Africa Automotive Directory lists all major auto parts importers in 49 African countries and is available for immediate download in Excel format. This special directory is updated every six months is available for sale at the Africa Business Pages B2B portal at a nominal cost of US$350.

The African Automotive Directory compiled by Africa Business Pages has emerged as a helpful resource for those looking for buyers of automotive spare parts in Africa. The Africa Automotive Directory lists all major auto parts importers in 49 African countries and is available for immediate download in Excel format. This special directory is updated every six months is available for sale at the Africa Business Pages B2B portal at a nominal cost of US$350.

The Africa Automotive Directory has helped many exporters, manufacturers and dealers of automotive spare parts connect with their business counterparts in the African markets and develop direct business relations and expand their sales and distribution network in key African markets.