Nigeria's Tyre Market

Globally, the leading tyre manufacturers today include Bridgestone, Michelin, Goodyear, Continental, Pirelli and Sumitomo (for Dunlop brand). World production of tyre is estimated to be 860 million units annually. Within Africa, significant tyre factories exist in Egypt, South Africa and Zimbabwe. Nigeria tyre market is now emerging as a leading importer of tyres in West Africa.

The Nigerian tyre industry took off shortly after independence in 1960 with both Dunlop Nigeria Plc and Michelin Nigeria Limited establishing their respective manufacturing outfits. By the Year 2005, the combined annual local capacity was 2.25m units, representing 75% of Nigerian tyre market at that time. These two companies were the only tyre manufacturing outfits in Nigeria, and indeed the West Africa region. Africa accounts for less than 1% of the global tyre production, while Nigeria then produced only about 0.2% when its factories were fully

The Nigerian tyre industry took off shortly after independence in 1960 with both Dunlop Nigeria Plc and Michelin Nigeria Limited establishing their respective manufacturing outfits. By the Year 2005, the combined annual local capacity was 2.25m units, representing 75% of Nigerian tyre market at that time. These two companies were the only tyre manufacturing outfits in Nigeria, and indeed the West Africa region. Africa accounts for less than 1% of the global tyre production, while Nigeria then produced only about 0.2% when its factories were fully

operational before the owners of the two tyre factories (Dunlop Nigeria Plc and Michelin Nigeria Ltd) shut them at the end of 2008 and 2006 respectively, due to the harsh operating environment (infrastructural deficiency, tariff structure, etc).

THE NIGERIAN TYRE MARKET

In the last forty years and starting during the oil boom years, the increased number of cars in Nigeria over saturated Nigerian roads. The demand for tyres kept growing over the years and the tyre market, like many other markets in the country at that time, was a seller’s market. This growth continued until the economy started to decline in the last twenty years as a result of the world’s energy crisis, coupled with our own internal problems. Over the last 20 years or so, it had become difficult to buy new cars and most people had to resort to second hand (Tokunbo) cars. The market reacted by importing an increasing number of second hand cars into the country from different parts of the world, which became more affordable and influenced the car tyre market in several ways.

In the Nigeria tyre market, there are both premium and budget (cheaper tyres), but the ever declining purchasing power of the consumers continued to make the budget tyres more attractive. Budget tyres (which account for about 80% of the Nigerian total tyre market) are imported mainly from Asian countries. These are usually low quality, low priced tyres, allowed into the country so long as they meet the standards set by Government agencies. Standards Organisation of Nigeria is expected to inspect these tyres on arrival.

The global tyre market is estimated to be $190 billion while the tyre market in Nigeria is about $1.0 billion. The total Nigerian tyre market size is estimated to be 5.7 million units (car, van & light truck – 3.9m and truck – 1.8m) with a projected growth rate of 3-5% annually). There are about 150 brands of tyres in the Nigerian market with five dominant players namely: Dunlop, Michelin, Bridgestone, Pirelli and Firestone. By 2008, all the imported brands accounted for about 90% share of the market as against only 25% in 2005. Today, all the tyres in the Nigerian market are imported following the cessation of local tyre manufacturing.

DOWNLFALL OF THE TYRE INDUSTRY IN NIGERIA

Dunlop was incorporated on October 21, 1961, beginning with tyre imports and started production in 1963. The raw materials for tyre manufacturing are natural and synthetic rubber, carbon black, wires, zinc oxide and other chemicals. All the raw materials are imported except zinc oxide, mineral oil and natural rubber. Warri Petrochemicals produced 2 out of 6 grades of carbon black used by the tyre industry locally.

Dunlop Nigeria Plc, when the import duty tariff on both car & truck was 40%, started importing Heavy Truck Radial (HTR) in 2000. The company subsequently embarked on the local production of Heavy Truck Radial, which was part funded by National Automotive Council (NAC) through its NAC- Automotive Development Fund. The HTR factory was commissioned by in 2005. Barely 4 four months after, there was a reduction in HTR tariff to 10% from

Dunlop Nigeria Plc, when the import duty tariff on both car & truck was 40%, started importing Heavy Truck Radial (HTR) in 2000. The company subsequently embarked on the local production of Heavy Truck Radial, which was part funded by National Automotive Council (NAC) through its NAC- Automotive Development Fund. The HTR factory was commissioned by in 2005. Barely 4 four months after, there was a reduction in HTR tariff to 10% from

40%.

In December 2006, Michelin Nigeria Limited shut its factory due to the harsh operating environment (infrastructural deficiency, tariff structure, etc), disposed its equipment and left, after 43 years of operations in Nigeria. Dunlop Nigeria Plc continued despite the fact that the problems that made Michelin to relocate out of Nigeria also affected it but remained with the hope that those problems would be addressed.

Unfortunately, these problems made it difficult for Dunlop to dispose its tyres (both truck and car) at reasonable margins because it had to compete with imports at 10% duty rate and the attendant infrastructural disadvantage which increased its production cost by about 40%.

Both companies (Dunlop and Michelin), before and after 2006, had on several occasions drawn the attention of the government at all levels to these problems. Regrettably, not much response was received from the relevant authorities, and because it could not continue to erode its shareholders funds, Michelin was forced to stop production at its factory by December 2006 while Dunlop followed the same path in December, 2008. They have both since joined the league of those importing tyres into Nigeria.

The closure of the two tyre factories in the country have resulted in loss of over 3,000 direct and several thousands of indirect jobs, closure of many smaller feeder cottage industries that serviced the factories, non payment of taxes etc.

REVIVING THE TYRE INDUSTRY IN NIGERIA

The Nigeria tyre market is generally placed under “strategic industrial sector “in any nation. In Nigeria, during the Civil war 1967-1970, because of the location of Michelin factory in Port Harcourt, it could not function, and as a result virtually all the tyre requirements of the Nigerian Armed forces were supplied completely and exclusively by Dunlop Nigeria Plc. Most of the tyres used by the peace keeping forces in Africa were equally supplied by Dunlop Nigeria.

The mass transportation sector in Nigeria is currently facing major challenges. The rail and water mode of transportation are not fully developed and this leaves road mode of movement as the most viable, significantly strategic and most preferred, and by extension, tyre becomes the singular most important component in the road mode of transportation.

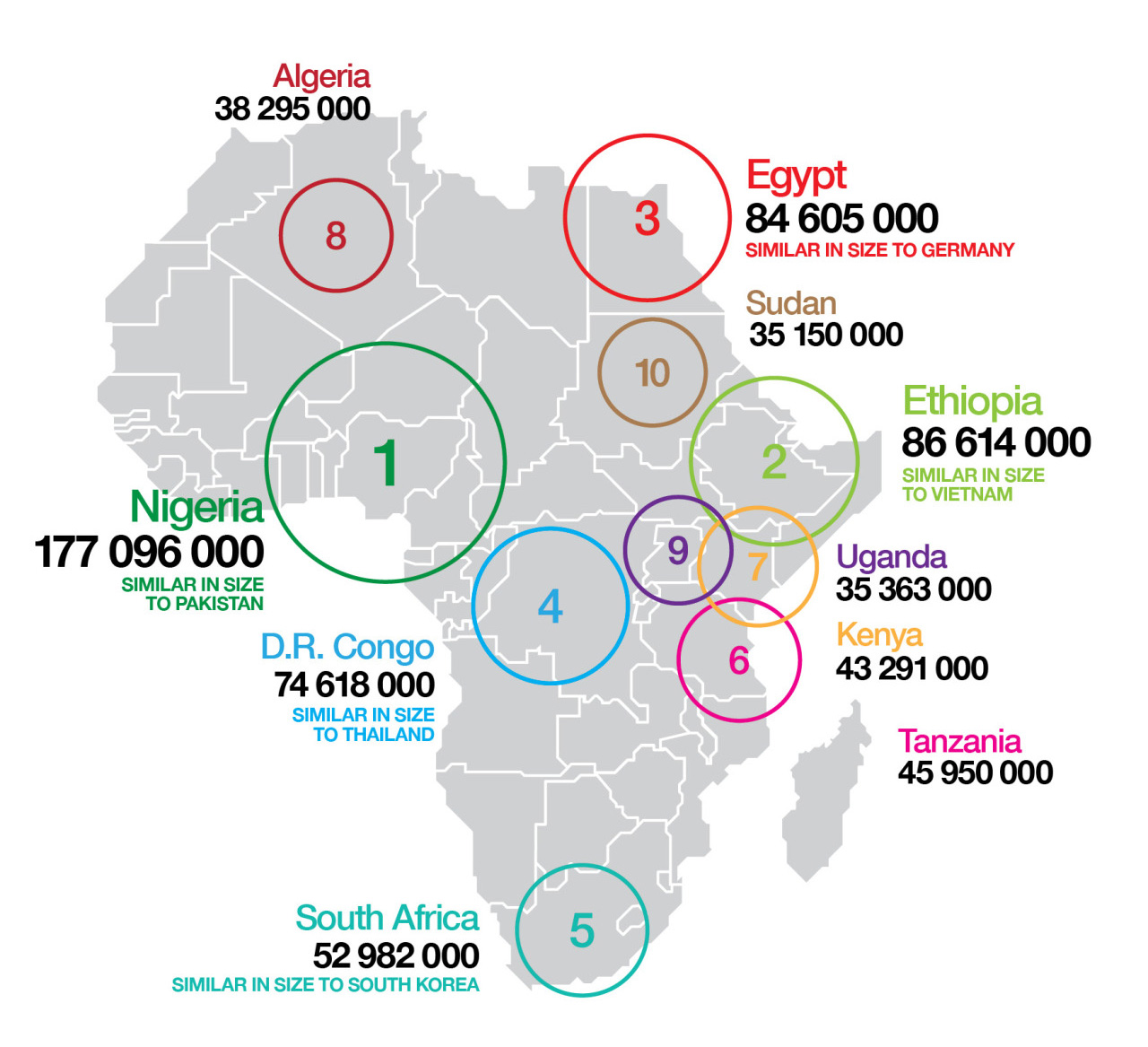

The national tyre demand annually is very large, enough to accommodate at least five different tyre factories with capacity of 20 million kg or 1m car/van tyres each. Thus, the combined capacity of over 100m kg will just be about enough to optimise the market in Nigeria. This excludes the rest of West Africa which is about another 50% of Nigeria tyre market.

The national tyre demand annually is very large, enough to accommodate at least five different tyre factories with capacity of 20 million kg or 1m car/van tyres each. Thus, the combined capacity of over 100m kg will just be about enough to optimise the market in Nigeria. This excludes the rest of West Africa which is about another 50% of Nigeria tyre market.

These tyre factories have potential of creating over 10,000 direct jobs, and several thousands of indirect job openings. Creation of smaller feeder cottage industries, payment of taxes, better security situation and positive impact on the national economy are all the positive implications of a functional Nigeria tyre market.

The natural rubber, carbon black and other petro chemicals available in Nigeria will also be value addition processes. The subsidiary Company of Dunlop, Pamol Nig. Ltd., has 15,000 hectares of land across Cross River, Delta and Edo states and employs not less than 10,000 persons directly and indirectly in its rubber plantation business. Michelin, on the other hand, has bigger rubber plantations in Ogun and Edo states but while Dunlop used its raw rubber in the local production of tyres up to December 2008, Michelin exported its raw rubber out of the Country and then imports their finished tyres back in to the country, since January, 2007.

Considering the strategic need for the tyre industry and its attendant benefits, it is imperative to revive the industry without further delay. The new auto policy introduced by the government recently is a positive step in this direction. To make the implementation of the policy more effective, there is need for a monitoring body consisting of SON, Customs and tyre manufacturers’ representatives to regulate tyre importation into the country. The ongoing reforms and efforts in the power sector are commendable and should continue. This will address quite a number of manufacturing challenges facing the tyre industry in the country.

DEMAND IN NIGERIA TYRE MARKET

The Nigeria tyre market is very strategic for the nation and should be revived. The import-friendly policies that are crafted ostensibly out of not envisaging the full implications on the Nigerian economy should be discouraged. The recent auto policy announced by the Nigerian government is a positive step in this direction. The current situation where tyres that can be manufactured locally are imported will only help to fuel job creation in other countries while unemployment in Nigeria country continues to rise, with all the security implications. The Nigeria tyre market can play a crucial role in job creation too.

Recent policy articulations and implementations by our government in respect of power, cement, rice, sugar, etc gives a lot of room for optimism that the new National Automotive Policy would also be faithfully implemented. Specifically, the policy as it affects encouraging local tyre manufacture includes pioneer status which gives 7-year tax holiday, zero duty on imported tyre manufacturing equipment, 5% import duty on raw materials and on tyre imports to augment local production in the first two years, while ramping up capacity.

Nigerian government’s more critical understanding of the implications of the ECOWAS/EU Partnership Agreement also signifies a new level of enlightened self interest towards job creation opportunities for its teeming youth population, while ensuring value addition to its abundant major tyre manufacturing raw materials, such as natural rubber and carbon black, both of which make up about 70% volume. Both Nigeria's petrochemical and steel resources also hold strong promise to provide the bulk of the remaining major raw materials for tyre manufacturing, into the future.